|

www.Finackle.com Auto Loan Auto Loan Guide Step 7: Negotiate on the Lot to Lower Your Auto Loan Costs

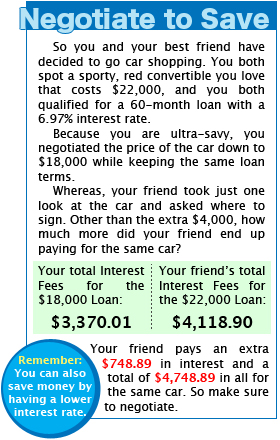

By negotiating, you not only save money by lowering the price of the automobile, but also by lowering the amount of interest you will have to pay on your auto loan. To understand why negotiating lowers the amount of interest you pay, lets review some auto loan basics. The amount of money you borrow to finance your automobile is known as the principal. The amount of money you are charged to borrow the principal is called the interest. Your lender will expect you to repay your principal and to pay the interest. Therefore, the total cost of your auto loan will be made up of your interest and principal payments.

How to Haggle to Get a Better Price and Smaller Auto Loan Now that you are convinced that you must negotiate, here are a few pointers to help you get the lowest price. Know the Invoice and MSRP Price. The Invoice Price is how much the dealer had to pay for the automobile. The dealer won't ever want to sell you the automobile at the invoice price, because that means they won't make a profit. The MSRP price is the manufacturer's suggested retail price, which is what the dealer hopes to charge you for the automobile. Notice that the MSRP price is a suggestion. You do not have to pay that price, which means you should negotiate for a lower one. Some dealers will negotiate 10 - 20% of their profit, which means the price of the automobile will fall between the invoice and MSRP price ("Buying A New Car"). The lower price means you will have a smaller auto loan, which is the end goal. Research Dealer's Rebates. Sometimes dealer's can buy the automobile you want for below the invoice price. That is because the automobile manufacturer gives the dealer a rebate if they sell the automobile. Knowing how much the dealer is saving on the invoice price can help you get a better price. For example, say the automobile you want has an invoice price of $19,000 and if the dealer sells the car they get $3,000 back. Then you know that the dealer is really only paying $16,000 for the car. As a result, the dealer may be willing to let you pay a lower price. Unfortunately, you must do some research to find out about dealer rebates. Before going to the dealer's lot look at www.carsdirect.com and www.edmunds.com to see if the car you're looking at has a dealer's rebate (Orman 261). Beware of ADP. If you see ADP listed anywhere, just know that it stands for additional dealer profit ("Buying A New Car"). Take any ADP you see into consideration when you are negotiating. You don't want to give the dealer any more money than you have to. Know How the Lower Price Will Affect Your Financing Options. If a dealer is offering a special auto loan for a certain automobile, they may not let you negotiate on the price ("Buying A New Car"). In that situation, you can either take the lower price or the special auto loan with low interest rates. Before choosing, do the math. See which situation you will pay less for in the end. The Rest of Our Auto Loan Guide: Introduction to Our Auto Loan Guide Step 1: The Car Loan Basics Step 2: Judging Which Auto Loans You Can Afford Step 3: Finding the Best Auto Loan Rates Step 4: How Your Credit Score Affects Your Car Loan Rates Step 5: The Difference Between Used and New Car Loans Step 6: The Best Places to Find Car Loans Step 7: Negotiate on the Lot to Lower Your Auto Loan Costs Step 8: Prepayment Terms and Automobile Loans Step 9: Traditional and Online Auto Loans Fact Sheet © Copyright www.Finackle.com |