|

www.Finackle.com Bad Credit Loans Bad Credit Loan Guide Step 1: The Basics of Bad Credit Loans

Well, I hate to break it to you, but you're that annoying friend, and your lender is the one thinking, "There's no way I'm doing that." Because when lenders consider giving out bad credit loans, which are loans given to people with bad credit scores, they are doing people like you big favors that they would normally never do. That is, unless you offer them some kind of incentive. Unfortunately, your lender doesn't think cutting their grass for a year is good enough. They only are enticed by money -- that is large amounts of money. So, get ready to pay when looking for bad credit loans. Why Bad Credit Equals Expensive Loans You may be wondering how having bad credit makes you the annoying friend asking for the favor. Well, it all comes down to what having bad credit means.

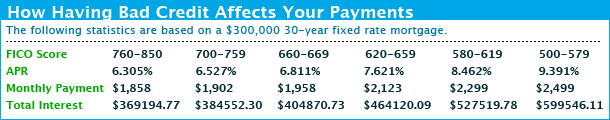

Now that may not seem fair because obviously you wouldn't need a bad credit loan if you weren't having financial problems. And the only reason you need the bad credit loan is because you really need the money. But come on, would you lend $100 to someone who you didn't think would pay it back? I didn't think so. The best way to look at bad credit loans is that you have to pay an extremely high extra fee because you are risky. Now I know that some people may find risky sexy, but not lenders -- that is when it comes to money. To see how much credit scores affect interest rates on bad credit loans, look at the chart below. As a reference point, having bad credit means you have a very low credit score. The lower your score, the worse credit you have.

As you can see having a bad credit score of 500 would leave you with a monthly payment of $2,499, which is $641 more than someone with a credit score of 760 would have to pay for the same exact amount of money. Over the life of the loan, a person with a credit score of 500 would have to pay $230,351.34 more than someone with a credit score of 760. That's almost as much as the amount of money they both borrowed, which was $300,000. So you can tell that bad credit loans are extremely expensive. The Rest of Our Bad Credit Loan Guide: Step 1: The Basics of Bad Credit Loans Step 2: Your Bad Credit Loan Options Step 3: All About Your Credit Rating © Copyright www.Finackle.com |