|

www.Finackle.com Consolidation Loans Consolidation Loan Guide Step 1: The Ins and Outs of Consolidation Loans

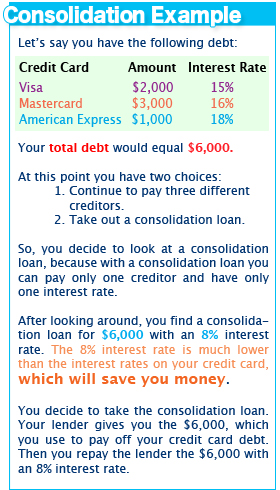

What are Consolidation Loans? Consolidation loans are loans used to pay off several other loans or debts. When you get a consolidation loan, you borrow enough money to pay off all of your debt. Unfortunately, they don't eliminate any of your debt. Instead, they put all of your debt into one giant loan so you have to pay only one lender rather than many (Frey). Although you still owe the same amount of money, consolidation loans may be able to lower your interest rate, which can lower your monthly payments (Downey). For example, imagine you have $6,000 in total debt. You owe one credit card company $2,000 at an interest rate of 15%, another credit card company $3,000 at an interest rate of 16% and a third credit card company $1,000 at an interest rate of 18%. You can take out a consolidation loan for $6,000 that has an interest rate of 8% and pay off all three credit card companies. You will be left with one monthly payment, instead of three, and you will only be paying an 8% interest rate, which is much lower than what the credit card companies were charging. Sounds good, right?

Types of Consolidation Loans There are two main types of consolidation loans: unsecured consolidation loans and home equity consolidation loans. Each type of consolidation loan has its own advantages and risks. Being familiar with each type will help you make a better decision about how to manage your debt. Unsecured Consolidation Loans: Unsecured consolidation loans are used to pay off other debts. They are personal loans that don't require collateral (Sutton). When a lender asks you for collateral they are asking you to agree to give them something of value that you already own, such as a home or a car, if you are unable to pay off your consolidation loan. When a bank doesn't ask you for collateral, they are putting themselves at risk if you default on the loan. Therefore, unsecured consolidation loans, which do not require collateral, are very risky for the lender. Because you risk nothing when you get an unsecured consolidation loan, they can be a big help in easing your credit burden if you can find one (Michael). However, they are usually very difficult to get especially if you already have a significant amount of debt because banks will be taking a huge risk when lending you the money (Sutton). Banks will see you as a credit risk and will not want to give you an unsecured consolidation loan. Instead they will only offer a loan that requires some sort of collateral as security -- usually your home's equity. But, if you can get an unsecured consolidation loan at a good interest rate, they can lower your costs and help you get out of debt sooner (Sutton). Pay special attention to the words "get out of debt sooner" because charging up more debt after consolidating will jeopardize your financial future (Michael). There is always a great risk when using your home as collateral because if you can't make the payments, your lender can foreclose on your home (Sutton). Take this warning seriously: Only consider a home equity consolidation loan if you are not going to accumulate anymore unsecured debt. Consider the decision very carefully because if you don't manage your debt better after a home equity consolidation, you will loose your house (Michael). Consolidation loans can be an excellent way to improve your credit situation if you do the necessary research and carefully analyze your situation. Read all the fine print in your loan agreement before signing, especially in regard to interest rates and fees (Downey). Also, shopping around can help you find better deals. Just because one lender won't give you an unsecured loan doesn't mean that another won't. If you are committed to eliminating your debt and are willing to do your homework, consolidation loans are a good option to consider. The Rest of Our Consolidation Loan Guide: Introduction to Our Consolidation Loan Guide Step 1: The Ins and Outs of Consolidation Loans Step 2: How to Get a Debt Consolidation Loan Step 3: Pros and Cons of a Home Equity Debt Consolidation Loan © Copyright www.Finackle.com |