|

www.Finackle.com Education Loans Student Loan Guide Step 1: Learning the Basics of Education Loans

To help you find the best education loans, we've put together an Education Loan Guide. This guide will help you save money when looking for education loans. And trust me, we know what you're feeling. College tuition sticker shock can be bad. With the average tuition of four-year private colleges at $21,235 a year and four-year public colleges at $5,491, education loans are nearly a requirement for most students and parents (College Board). But before we can get into the tricky stuff, we first need to get through the basics. What are Education Loans? Education loans are loans used to pay for a college education. They work like any other consumer loan. You receive money to use on college expenses, and you must pay it back along with the interest. The amount of your interest payments will depend on your interest rate. Education loans can be from the government or private sources, such as your local bank, and both parents and students can take out education loans. Where Can I Find Education Loans?

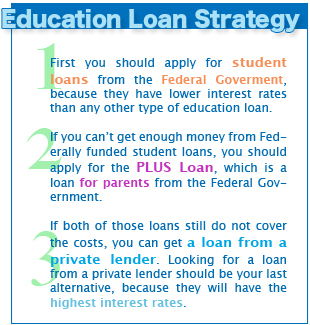

Private banks, credit unions, savings and loan associations and other financial institutions also offer education loans. Those loans can either be home equity loans, home equity lines of credit or alternative loans, which are specifically designed for funding college educations. Each type of loan, whether public or private, has its own qualifications, as well as benefits and detriments. We'll go more in depth about the different types of loans later in this Student Loan Guide. If you would like to read about government loans for students skip ahead to Step 2: All About Federal Student Loans. How do I Apply for Education Loans? The application processes for federal education loans and private education loans are somewhat different. Federal education loans are very easy to apply for. You simply have to complete a Free Application For Federal Student Aid, the FAFSA. That one form applies you for all the different financial aid programs offered by the federal government. It isn't difficult to complete and can be completed online or by mail. Private lending institutions each require their own applications. When you find a lender that you are interested in, you can either request an application or fill one out online. Most applications can be filled out in about a half hour and aren't too difficult. Keep in mind that most students and parents only use private lending if the federal financial aid wasn't enough to cover tuition and living expenses. That is because, among other things, private education loans are usually more expensive than government loans, with higher interest rates and fees (FinAid.org). The first step to funding your education is to apply for government education loans by getting a Personal Identification Number, your PIN, and completing a FAFSA - if you want immediate information about PINs and FAFSAs, skip ahead to Step 3: How to Apply for a College Loan From the Federal Government. Once the government and your college process the application, you will then receive an Award Package that details which federal aid programs you qualified for and the amounts of money you are eligible to receive from each. You can accept, decline or reduce any of the awarded money. If the student's Award Package isn't enough to cover college expenses, parents should apply for a PLUS Loan from the federal government. At that point, if you still need more funds to pay for college, look for outside funding from private institutions. Beyond the basics, there is much more to know about education loans. The next part of the Student Loan Guide, Step 2: All About Federal Student Loans, will discuss government education loans for students. Below, you will find quick links to each section of our Student Loan Guide. The Rest of Our Student Loan Guide: Step 1: Learning the Basics of Education Loans

Step 2: All About Federal Student Loans Step 3: How to Apply for a College Loan From the Federal Government Step 4: How Much Money to Expect from Your Student Loan Step 5: Get Extra Funding Through Parent College Loans Step 6: How to Get an Alternative College Loan © Copyright www.Finackle.com |