|

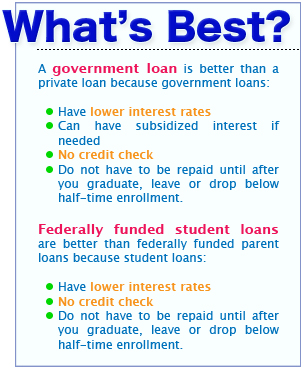

www.Finackle.com Student Loans Student Loan Guide Step 2: All About Federal Student LoansWhy Should I Choose Federal Student Loans? Your two main options for student loans are federal loans or private loans, which are offered by numerous banks, savings and loan associations and other financial institutions. Although many students and their families look to private lenders for help paying for college, it is recommended that you only do so after utilizing all government financial aid that is available (FinAid.org). That is because federal student loans have lower interest rates and can be subsidized -- you don't have to pay interest ("Why Get a Federal Student Loan"). Also, you don't need to pass a credit check to qualify, and you don't have to pay the loans back until after you graduate. Why are Student Loans Better than Parent Loans?

Types of Federal Student Loans: Federal Perkins Loan Program: Perkins Loans are granted to undergraduate and graduate students who have great financial need ("Campus-Based Aid). They have a 5.00% fixed interest rate, and you can borrow up to $4,000 each year. Your college handles the money, and you must begin repayment to your college starting nine months after you graduate, enroll below half-time or leave school ("Campus-Based Aid"). They are the best deal financially if you qualify because of their very low interest rate and generous repayment schedules. Stafford Direct Student Loans: The US Department of Education is the lender for Stafford Direct Student Loans. Direct loans come in two forms: subsidized and unsubsidized ("Stafford Loans"). Subsidized Direct Loans are need based and don't require you to pay any interest. Unsubsidized loans are available regardless of need, but you are responsible for paying interest on your loans. The interest rate for all Direct loans disbursed on or after July 1, 2006 is fixed at 6.80% ("Stafford Loans"). The amount of money that you can borrow depends on several factors, such as whether you have a subsidized or unsubsidized loan, your grade level and dependency status. Upon graduating, entering half-time enrollment or leaving school, you will have six months before you must start repaying your loan. How do I Apply for Student Loans? The application process is very simple for all federal student loans. By filing out and submitting the Free Application For Federal Student Aid, the FAFSA, you apply for all federal student loans. Once the government and your college process your application, you will receive an Award Package that details all the grants, loans and other financial aid programs that you are eligible for. All you must do is accept, decline or reduce the amount of the various offers. The FAFSA itself isn't overly complicated. The most tedious part is filling out the student and parent financial information sections. However, considering how many programs you are applying for with that one application, it is easy. To learn about the FAFSA, read the next section of our Student Loan Guide Step 3: How to Apply for a College Loan From the Federal Government, which is all about how to apply for a college loan. The Rest of Our Student Loan Guide: Step 1: Learning the Basics of Education Loans

Step 2: All About Federal Student Loans Step 3: How to Apply for a College Loan From the Federal Government Step 4: How Much Money to Expect from Your Student Loan Step 5: Get Extra Funding Through Parent College Loans Step 6: How to Get an Alternative College Loan © Copyright www.Finackle.com |