Construction loans are used to finance building a new home.

Construction loans do not work like regular loans. Before you look for

construction loans, it is important that you understand how they work.

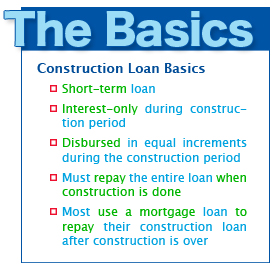

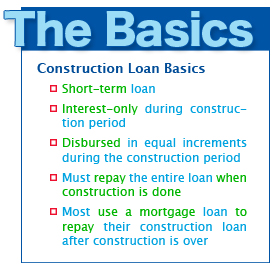

Most construction loans are interest-only loans during the construction period, which means you do not have to pay any principal payments until the loan is due (Fisher 146). When the loan is due, you will be expected to pay the total amount that you borrowed. Construction loans are due as soon as the construction is done (Lank 347). Once your home is built, you are expected to repay the full amount of the loan either out of pocket or with a mortgage. Most people must get a mortgage because they don't walk around with that kind of money in their pockets. The money they get from the mortgage is used to pay off their construction loan.

When you get a construction loan, don't expect to walk away from your lender with the total amount you borrowed. Instead you will receive your loan in installments (Lank 347). Construction loans work differently than most loans because they don't have collateral (Lank 347). If the term collateral is confusing, think of the last time you went bowling. Before the bowling alley gives you a pair of those stylish shoes, you may be asked to give them your driver's license, keys or cell phone. The bowling alley makes you do that because they lose money if you don't return their shoes. They use your personal item as collateral to make sure you bring back their lovely shoes.

|

| Infographic Credit: Meghan Carter |

Lenders use the same concept of collateral when they give out loans. However, they can't just take your driver's license and expect you to repay your loan. Instead, they use a bigger incentive, such as your house. When you take out a mortgage, your lender will be given your house if you are unable to make your monthly payments. If the lender did not get your house, then they would not have an incentive to give you that large of a loan.

But with construction loans, lenders must give out a large amount of money without any collateral because the collateral has yet to be built. That is very risky for the lender, because they have no assurance that they will ever be repaid. For all they know, your house may end up half built and uninhabitable, which is worthless to them.

To solve that problem, lenders do not give out the full sum of money right away. When lenders give out construction loans, they give out the money in installments. Construction loans are normally given in four equal installments (Fisher 146). Your construction loan agreement should specify the criteria for disbursement, which is sometimes called a "draw schedule" (Clough 7). For example, your construction loan may state that once 25% of the work is complete, you can draw 25% of your loan. An appraiser will come to the job site to make sure that 25% of your new home has been built. Then you will be given 25% of your total construction loan. Once 25% more of your house is completed, you will be given 25% more of your construction loan, and so on.

Luckily, you only have to pay interest on the amount of money you have used. Construction loans work much like credit cards. You have a total limit that you can spend. However, you are only charged interest on the amount you have borrowed. For example, let's say you have a construction loan for $400,000. Your construction loan agreement states that for every 25% of your house that is completed you can draw 25% of your loan. You have just had the first 25% of your loan disbursed. Therefore, you only need to pay interest on $100,000, not $400,000.

While construction loans are different than most loans, once you understand the basics you will be able to find the right one for you. To learn how to apply for construction loans, read

Step 2: How to Get a Construction Loan. It not only tells you how to apply for construction loans, but also tells you about the two types of construction loans, how much money you will need and how much money to expect to get from lenders.

The Rest of Our Construction Loan Guide: