A signature loan, which is a type of personal loan, can be used to

purchase almost anything, from new furniture to a luxury vacation to

home renovations. Although a signature personal loan offers several advantages

over other forms of credit, there are some drawbacks.

What is a Signature Personal Loan? A signature personal loan is a consumer loan that doesn't require collateral, which means you don't have to pledge an asset to secure the loan. A signature personal loan is often used to purchase nondurable goods, such as vacations, or to cover temporary cash shortages (Gitman). A signature personal loan is usually less than $10,000 and must be repaid within 5 years (Lister). However, because the signature personal loan is unsecured, which mean it has no collateral, the interest rate is usually higher than that of mortgages or home equity loans (Weltman). In addition to a high interest rate, another drawback of a signature personal loan is that it is hard to obtain because you must have good personal credit and be able to demonstrate a strong ability to repay the money. So, you need to watch out for high interest rates and fees when searching for a signature personal loan.

How do I Apply for a Signature Personal Loan? Although a signature personal loan can be difficult to obtain, the application process is easy. Often, a signature personal loan application is processed and approved in just hours or days (Lister).

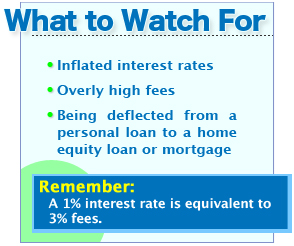

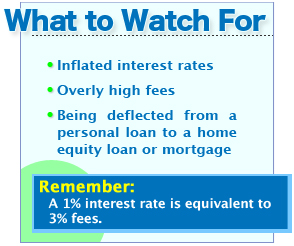

The first step in applying for a signature personal loan is to search for the best deal you can find. Look for both a low interest rate and low fees. When comparing loans, keep in mind that a 1.0% higher interest rate is equivalent to about 3.0% more in fees (FinAid). Therefore, a $5,000 loan with a 6% interest rate and 0% fees would cost the same as a $5,000 loan with a 5% interest rate and 3% fees.

Once you have found a lender offering a good, low rate and minimanl fees, request an application or fill out one online (Weltman). The signature personal loan application will likely be about four pages long and ask for information about your credit history, work history, assets and income (Lister, Antonini). You will also have to submit your tax returns for the last two to three years and proof of how much you are currently making (Antonini).

|

| Infographic Credit: Meghan Carter |

What to Watch Out For To find a good interest rate for a signature personal loan, you should shop around. Don't settle for one that has a rate similar to a credit card. You can do much better. Besides high interest rates, also be leery of lenders who try to deflect you from an unsecured signature personal loan to a secured loan, such as a home equity loan. They may have lower interest rates, but you will be risking loosing your home or another asset if you can't make your payments.

What Will the Lender be Looking For? The lender will be looking for a good credit history and that you have enough assets and income to cover the signature personal loan as well as any other debts you owe. The lender will also be crosschecking your tax returns against your application; so don't try to inflate your application. The lender will be able to tell (Antonini). So, don't lie.

If you have had bad credit in the past or there is a significant change between your current situation and what is shown on past tax returns, be sure to explain those situations in your application (Antonini). For example, if you had a period of medical problems when you were unable to pay your bills for a few months, just give a brief explanation of what happened and why the situation is better.

Or if you have received a promotion recently and your income is substantially greater than what your past records show, bring it to the lender's attention. If you don't anticipate such questions, your application will take longer to process. Conversely, don't provide the lender with extra information beyond what is necessary (Weltman). You don't need to give the lender any extra reasons not to approve your loan.

A signature personal loan can help you through a hard time or enable you to live a little easier. But you must be cautious and do the research and work necessary to find a good deal. Always remember to read the fine print, ask lots of questions and never sign any paperwork for a signature personal loan until you know exactly what you are getting and what you must give in exchange.

The Rest of Our Personal Loan Guide: