Before getting an auto loan, it is

important to understand how to buy a car.

When you buy a loaf of bread, you pay the price on the price tag. But when you buy an automobile, you negotiate. And I promise, it can be fun. Especially, when you're able to knock a couple thousand dollars off the price of the automobile you covet and have a smaller auto loan.

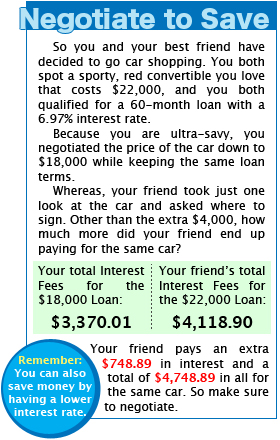

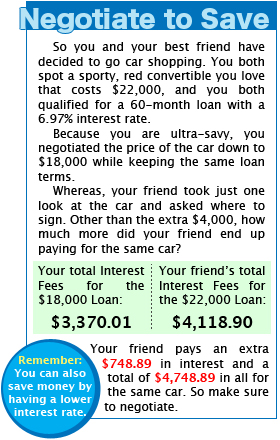

By negotiating, you not only save money by lowering the price of the automobile, but also by lowering the amount of interest you will have to pay on your auto loan. To understand why negotiating lowers the amount of interest you pay, lets review some auto loan basics.

The amount of money you borrow to finance your automobile is known as the

principal. The amount of money you are charged to borrow the principal is called the

interest. Your lender will expect you to repay your principal and to pay the interest. Therefore, the total cost of your auto loan will be made up of your interest and principal payments.

|

| Infographic Credit: Meghan Carter, Statistics from Bankrate.com |

One of the best ways to decrease the total amount of your auto loan is to decrease the amount of your principal. That is because reducing your principal reduces the amount of interest you pay. To determine your interest fee, the lender uses the interest rate and multiplies it by the amount of principal you have. While that is a simplified version, it shows that the more principal you have, the more interest you will have to pay on your auto loan. Therefore, by borrowing less money, you will pay less interest. To see how much you can save by negotiating a lower cost, look at the chart to the right. You'll see that the total price of your auto loan is much lower by haggling a little with the dealer.

How to Haggle to Get a Better Price and Smaller Auto Loan Now that you are convinced that you must negotiate, here are a few pointers to help you get the lowest price.

Know the Invoice and MSRP Price. The Invoice Price is how much the dealer had to pay for the automobile. The dealer won't ever want to sell you the automobile at the invoice price, because that means they won't make a profit. The MSRP price is the manufacturer's suggested retail price, which is what the dealer hopes to charge you for the automobile. Notice that the MSRP price is a suggestion. You do not have to pay that price, which means you should negotiate for a lower one. Some dealers will negotiate 10 - 20% of their profit, which means the price of the automobile will fall between the invoice and MSRP price ("Buying A New Car"). The lower price means you will have a smaller auto loan, which is the end goal.

Research Dealer's Rebates. Sometimes dealer's can buy the automobile you want for below the invoice price. That is because the automobile manufacturer gives the dealer a rebate if they sell the automobile. Knowing how much the dealer is saving on the invoice price can help you get a better price. For example, say the automobile you want has an invoice price of $19,000 and if the dealer sells the car they get $3,000 back. Then you know that the dealer is really only paying $16,000 for the car. As a result, the dealer may be willing to let you pay a lower price. Unfortunately, you must do some research to find out about dealer rebates. Before going to the dealer's lot look at www.carsdirect.com and www.edmunds.com to see if the car you're looking at has a dealer's rebate (Orman 261).

Start Low. Never let a car dealer know how much you can afford or how much you are willing to pay. If you give them that information, they will be in control of the negotiations by not accepting an offer lower than what you are able to afford or willing to pay. Instead, you must take control of the negotiations by giving them no information and starting your bid very low. When making your bid, take into consideration any dealer rebates on the car you want.

Beware of ADP. If you see ADP listed anywhere, just know that it stands for additional dealer profit ("Buying A New Car"). Take any ADP you see into consideration when you are negotiating. You don't want to give the dealer any more money than you have to.

Know How the Lower Price Will Affect Your Financing Options. If a dealer is offering a special auto loan for a certain automobile, they may not let you negotiate on the price ("Buying A New Car"). In that situation, you can either take the lower price or the special auto loan with low interest rates. Before choosing, do the math. See which situation you will pay less for in the end.

The Rest of Our Auto Loan Guide: