Have you ever had a friend ask you for a favor? Something you really didn't want to do, like go on a double date or spend the weekend helping them clean their gutters. At first you probably didn't want to, but after they agreed to do your laundry for a month or get you free tickets to the Knicks game you finally gave in.

Well, I hate to break it to you, but you're that annoying friend, and your lender is the one thinking, "There's no way I'm doing that." Because when lenders consider giving out bad credit loans, which are loans given to people with bad credit scores, they are doing people like you big favors that they would normally never do. That is, unless you offer them some kind of incentive. Unfortunately, your lender doesn't think cutting their grass for a year is good enough. They only are enticed by money -- that is large amounts of money. So, get ready to pay when looking for bad credit loans.

Why Bad Credit Equals Expensive Loans You may be wondering how having bad credit makes you the annoying friend asking for the favor. Well, it all comes down to what having bad credit means.

|

When the three all-powerful credit reporting companies - Equifax, Experian, and TransUnion - put together your credit score, they factor in five things. Those things are: whether you pay your bills on time, how much credit card debt you have compared to your credit card limits, how long you have had credit, how many new accounts and recent applications for credit you have had and how many credit cards and loans you have ("What's In Your Score"). You probably have to look for bad credit loans if you don't always pay your bills on time, you max out your credit card limits, you haven't had credit for a long period of time, you have opened numerous accounts and applied for many loans recently, or have too many credit cards and loans. Unfortunately, while your mom may find it endearing, to a lender all of those characteristics make you very undesirable.

When a lender looks at those qualities, they see someone who won't repay their loan. That means the lender will loose money on bad credit loans. So the lender thinks there is no way I'm taking that kind of risk unless each person is willing to pay a very large fee for the bad credit loan. As a result, people like you must pay higher interest rates than those with good credit. Having a high interest rate means it will be very expensive to borrow the money, which means bad credit loans are very expensive.

Now that may not seem fair because obviously you wouldn't need a bad credit loan if you weren't having financial problems. And the only reason you need the bad credit loan is because you really need the money. But come on, would you lend $100 to someone who you didn't think would pay it back? I didn't think so.

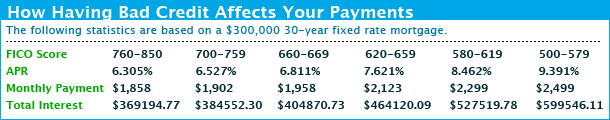

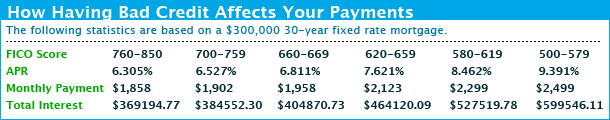

The best way to look at bad credit loans is that you have to pay an extremely high extra fee because you are risky. Now I know that some people may find risky sexy, but not lenders -- that is when it comes to money. To see how much credit scores affect interest rates on bad credit loans, look at the chart below. As a reference point, having bad credit means you have a very low credit score. The lower your score, the worse credit you have.

|

| Infographic Credit: Meghan Carter, Statistics from myFICO.com and Bankrate.com |

As you can see having a bad credit score of 500 would leave you with a monthly payment of $2,499, which is $641 more than someone with a credit score of 760 would have to pay for the same exact amount of money. Over the life of the loan, a person with a credit score of 500 would have to pay $230,351.34 more than someone with a credit score of 760. That's almost as much as the amount of money they both borrowed, which was $300,000. So you can tell that bad credit loans are extremely expensive.

The Rest of Our Bad Credit Loan Guide: