Home loan lending, more commonly referred to as a

mortgage, is when a borrower takes out a loan to purchase a home.

Before you look into home loan lending, you must be familiar with

mortgage basics. Without a good understanding of home loan lending, you

may end up paying much more for a mortgage than you should.

To truly understand home loan lending, you should think of a mortgage from the bank's perspective. Banks sell money like bakeries sell bread. When you buy money from a bank, commonly called taking out a loan, the bank charges you for it. Say you want to take out a $150,000 home loan. The bank's price for a $150,000 home loan may be $244,000. It may seem outrageous that banks can charge you more than $150,000 for a $150,000 loan, but its not. The extra money you pay is for convenience. You want to buy a house now, but you can't pay for it. So you pay an inflated price to the bank so that you can have that house ten years before you can actually afford it. You get your house and the bank makes money. Every one comes out happy, especially the bank.

The amount of money the bank lends you is called the principal. So the principal for a $150,000 loan is $150,000. The money the bank charges you for using the loan is called interest. In the above example where the bank charged $244,000 for a $150,000 loan, the interest is $94,000. When you go to repay the bank, you will have two payments. The first payment is the principal, which is repaying the money you borrowed. The second payment you make is the interest, which is the fee the bank charges you for using their money.

|

| Infographic Credit: Meghan Carter |

The amount of interest you have to pay the bank is determined by the interest rate for the loan. The interest rate is the percentage that you are charged each year for using the money the bank lent you. The higher the interest rate, the more money you have to pay the bank. For example, the total amount of interest paid on a 30-year $150,000 loan with a 5% interest rate is $139,883.68 ("Mortgage Payment Calculator"). Whereas, if that loan had a 10% interest rate, the total interest you would have to pay is $323,888.65 ("Mortgage Payment Calculator"). The 5% interest rate loan is $184,004.97 cheaper than the 10% interest rate loan.

Low interest rates are good for the borrower, which is you. When you have a low interest rate you pay less for the money you borrow. However, the banks want to charge high interest rates so that they can make more money. So when looking for a loan, shop around. You want to find a loan with the lowest interest rate possible.

A word of caution: When you borrow money from a bank for a home loan, your house is used as collateral. Which means that the bank will get your house if you default on your loan. To keep from losing your house, make sure you will be able to repay your loan. Otherwise you could lose everything.

Your Monthly Payments When you take out a loan, the bank charges you for both the principal and the interest. When those two payments are combined, it is a pretty big number. Most people can't afford to pay that back in one or two years. As a result, the bank gives you a long period of time, called a term, to pay back the loan. The term for most loans is 30 years ("Common Questions For First-Time Homebuyers").

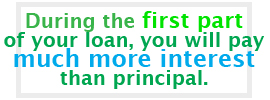

During the term of your loan, the bank normally charges you monthly payments. Those payments have two parts: the principal and the interest. While it would make sense to pay equal amounts of interest and principal each month for the life of the loan, it doesn't work that way.

|

During the first years of the loan, you will pay much more interest than you will principal. Banks make you pay more interest in the beginning because they want to ensure they make a profit. The banks know that you probably won't stay in your home for 30 years, which means after a few years you will pay back the mortgage completely (Orman 289). Because you would pay the mortgage back early, the banks would make very little money in interest. To solve that problem, banks charge you more interest in the beginning so they can make a larger profit. In addition to you moving, banks are also worried that you will default on your loan. If you are unable to make your monthly payments, the bank will get your house. Therefore, they are almost guaranteed to make back the money they lent you even if you are unable to pay back the loan. However, they are not guaranteed to make the interest they charged you for borrowing their money. As a result, they charge you for the interest first to make sure that they make a profit even if you must default on your loan.

To see how the interest and principal payments are broken down for a loan, look at an amortization chart for a loan. The chart will show you the total amount for the monthly payments and what part of each monthly payment is made up of principal and interest.

Interest Rates, Loan Size and Your Credit Score Home loan lending is always a risk for the banks. They hate to loose money, and if you default on your loan, they will. To keep from loosing money, banks only lend to those who they think will be able to make their monthly payments. Basically, banks will lend lots of money to you when you don't need it and no money when you really do. Which seems ironic. The banks should lend you money when you need it, right? Wrong.

|

| Infographic Credit: Meghan Carter |

When you need the money, banks think you won't be able to repay your loan, which means they will lose money. As a result, the bank will either deny you a loan, which guarantees that they won't lose money, or they will give you a very small loan with a high interest rate. Charging you a high interest rate -- which means you pay a larger fee for the money you borrow -- makes it more likely that the bank will make a profit even if you do default on your loan.

The banks don't need to charge an overly high interest rate to someone who is likely to repay their loan because banks are almost guaranteed to make a profit. Therefore, when it comes to interest rates and loan size, banks give bigger loans and lower interest rates to those who are more likely to pay them back and smaller loans with higher interest rates to those who find it difficult to make ends meet.

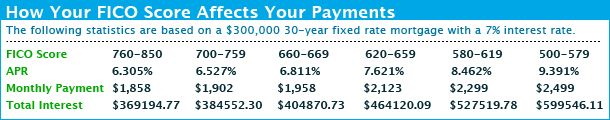

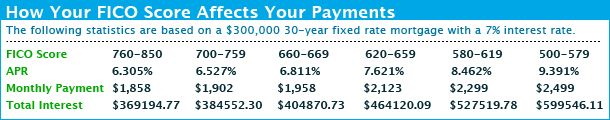

Your Credit Score Matters To determine what type of loan you qualify for, banks will look at your credit score. Your credit score is a barometer of how likely you are to repay your loan. It tells the banks how much debt you have, how good you are at paying your bills, how many accounts you have, how old your accounts are and other things about your credit history ("Credit Scoring"). If you have a high credit score, you probably have little debt, you pay your bills on time and you manage your accounts well. The banks will think you are creditworthy and will give you a bigger loan with a lower interest rate. However, if you have a low credit score, which means you have trouble paying your bills and have large amounts of debt, the bank will give you a smaller loan with a high interest rate.

To see how much your credit report affects your interest rate, look at the chart below. A person with a credit score of 500 has to pay $233,351.34 more than a person with a credit score of 850 for the same loan. The price difference is almost as much as the original loan amount. As you can see, having a bad credit score really affects your monthly payments. To learn more about your credit score, go to

Credit Rating.

|

| Infographic Credit: Meghan Carter |

Now that you understand Home Loan Lending Basics, it is time to learn about being pre-qualified and pre-approved. To read the next part of our Mortgage Guide, go to

Step 2: Being Pre-Qualified and Pre-Approved for Home Loans.

The Rest of Our Mortgage Guide: