While weaving your way through the home mortgage loan maze, you may be tempted by ads that offer down payments as low as 3%. Before you take the bait, you may want to reconsider. When getting a home mortgage loan, it is always better to put down a large down payment because you will save money and build equity. It may be hard to pay a large down payment; however, the bigger the down payment, the more money you save. So you will want to try to pay as large of a down payment as you can afford. If you aren't convinced that putting money towards a large down payment is worth it, here are four reasons that are sure to change your mind.

Why a Large Down Payments Saves You Money 1. Your Home Mortgage Loan Down Payment Goes Straight to Your Equity. Building up equity is a great idea because it means that you own more of your home. If you have equity in your home, you may qualify for a home equity loan or line of credit ("What You Should Know About Home Equity Lines of Credit").

|

| Infographic Credit: Meghan Carter |

The big plus side of home equity loans and lines of credit is that their interest rates are fairly low compared to a standard loan, which means you will save money ("What You Should Know About Home Equity Lines of Credit").

Home equity loans and lines of credit are especially important if you have an unexpected large expense that you can't afford, such as medical bills. Your down payment and principal payments all go towards your home equity. To determine how much equity you have, subtract what you still owe on your mortgage from the appraised value of your home ("Glossary").

2. You Will Pay Less in Interest.

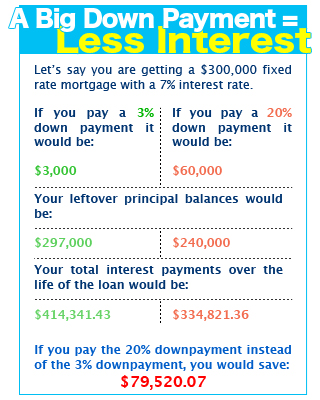

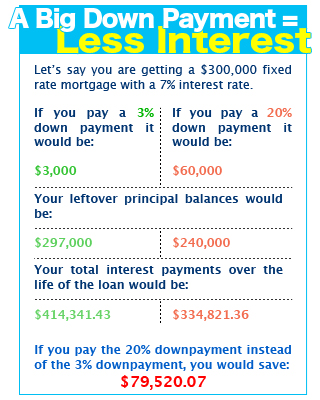

When you take out a home mortgage loan, you are charged interest for the amount you borrow, which is the principal. Therefore, the more money you borrow, the more interest you have to pay. To reduce the amount of interest you have to pay, you can put down a larger down payment. Your down payment reduces your amount of principal. To see the difference your down payment makes in the amount of interest you have to pay on a home mortgage loan, look at the chart above.

3. Your Interest Rate Will be Lower. If you put down a large down payment, your interest rates will be lower (Quinn 106). As a result, it will cost you less to borrow the money. The less you put toward your down payment, the higher your interest rates will rise and the more expensive your loan will become.

4. You'll Pay Less PMI. PMI stands for private mortgage insurance. You will be required to pay PMI if your down payment is less than 20% of your home mortgage loan ("100 Questions and Answers About Buying a New Home"). PMI will cost you about 0.5% to 1% of the value of your home mortgage loan (Opdyke 45). That cost can add up over the years. Luckily, if you have a good payment history and have paid 20% of the original purchase price or appraised value of your home at the time the loan was obtained, you can cancel your PMI ("Private Mortgage Insurance"). As a result, the larger your down payment, the less PMI you will have to pay. You obviously will save the most money by paying a 20% down payment; however, don't stress over trying to scrape together 20%. Instead, just try to put together the largest down payment you can afford.

Now that you know why you should pay as large of a down payment as possible, it is time to look at how your term length affects your home mortgage loan. To read the next step in our Home Mortgage Loan Guide, go to

Step 5: Term Lengths for Home Mortgages.

The Rest of Our Mortgage Guide: