When looking at home mortgages, pay close

attention to the term length. The term length of home mortgages has a

big impact on the amount of your monthly payments and the overall

amount you will pay.

The term is the amount of time you are given to repay your loan. During the term of your home mortgage, your lender will require you to make payments. Most people pay monthly payments during the length of their home mortgage's term. For example, if the term of your home mortgage was 30 years, then you would spend the next 30 years repaying your loan. If you were charged monthly payments, then you would make 360 payments to repay the money you borrowed.

Each of those 360 payments you make will consist of two payments: your principal and your interest. To review, the principal payment is the portion that repays the money your borrowed. The interest payment is the fee you are charged for borrowing the money. During the first part of your term, a larger portion of your home mortgage payments will be interest. In the latter years of your term, you will pay mostly principal. To see how the payments for home mortgages are broken down, you should look at an amortization table. It shows you the amount for each payment during the term of the loan.

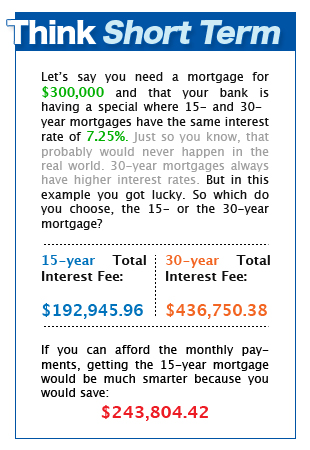

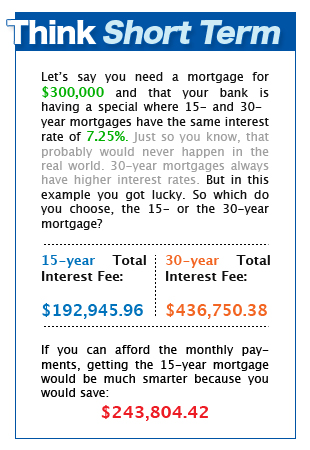

Home Mortgages' Term Lengths: Long or Short? When you first look at the monthly payments for a 30- and 15-year mortgage, I'm sure you will want the 30-year mortgage. It looks cheaper. The monthly payment for a 30-year $100,000 home mortgage with a 5% interest rate is $536.82; whereas, that same loan with a 15-year term has a monthly payment of $790.79 ("Mortgage Payment Calculator"). While the 30-year home mortgage looks cheaper, it's not. There are two reasons why longer-term home mortgages cost you more in the end:

|

| Infographic Credit: Meghan Carter |

Higher Interest Rates. Home mortgages with longer terms have higher interest rates ("100 Questions and Answers About Buying a New Home"). Therefore, a 30-year home mortgage would have higher interest rates than a 15-year home mortgage. It is more expensive to borrow money with high interest rates. If you choose a 30-year home mortgage over a 15-year home mortgage you will probably end up paying more money in interest.

More Interest Payments. If you have a 30-year home mortgage, you will make 180 more payments than someone with a 15-year home mortgage; that is if you make monthly payments. The person with the 15-year home mortgage will pay more principal with each of their payments because the term of their loan is shorter. As a result, with each payment the person with the 15-year home mortgage makes, they will be reducing a larger portion of their principal. Because the amount of your principal determines how much interest you must pay, the quicker you can reduce your principal, the less interest you owe. With a 30-year mortgage, it takes much longer to reduce the principal. Therefore, a person with a 30-year mortgage must pay much more money in interest because they have a larger amount of principal for a longer period of time. To really see that, look at the chart to the right. The person with the 30-year mortgage would have to pay $243,804.42 more in interest than the person with the 15-year mortgage. That's almost as much as the original amount of the loan. Talk about a lot of money.

As you can see from the chart, not only do you end up paying more for a longer term home mortgage because you are charged a higher interest rate, but also because you must pay more in interest over the length of the loan. Short-term home mortgages are also a better idea because they help you build equity faster. Your equity is made up of your down payment and principal. Equity is good because if you are ever in a pinch and need a large amount of money for an unexpected cost, such as $15,000 to repair termite damage, then you can take out a home equity loan or line of credit to pay for the expenses. The benefit of home equity loans and lines of credit over other loans is that they have lower interest rates that save you money. Short-term home mortgages build equity faster because each payment you make has a larger amount of principal than each payment for a long-term loan. To calculate how much equity you have, subtract the amount of money you still owe on your mortgage from the value of your home ("Glossary").

Short-term mortgages are not for everyone. The large monthly payments may be hard for some people to afford. However, if it is possible for you to afford a short term mortgage, take the time to look into it. You may save thousands of dollars.

The Rest of Our Mortgage Guide: