|

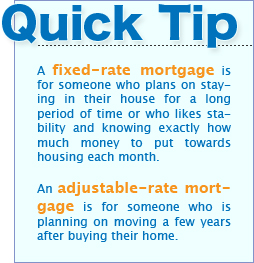

www.Finackle.com Mortgage Mortgage Guide Step 3: Choosing a Type of MortgageFixed-Rate Mortgage Getting a fixed-rate mortgage is like buying bread. You know exactly how much it will cost before you pay for it. That is because with a fixed-rate mortgage, the interest rate never changes over the life of the loan. Before getting a fixed-rate mortgage, you can look at your amortization table and know exactly how much it will cost you to borrow that money. A fixed-rate mortgage will have higher interest rates than the starting rates for an adjustable-rate mortgage; however, due to their consistency they are very secure. They are great for those who like to keep their finances consistent and don't like change because they always know exactly how much they owe. A fixed-rate mortgage is also good for those who plan to stay in the house they buy for the whole mortgage term (Opdyke 46). However, if you plan on moving a few years after buying your house, you may want to look into an adjustable-rate mortgage. Adjustable-Rate Mortgage Getting an adjustable-rate mortgage is like filling your car up with gas each week. You cannot plan ahead and budget an exact amount because you never know how much it will cost each time you go to pay. With an adjustable-rate mortgage, the interest rate varies. When you get the mortgage, you do not know how much you will have to pay over the life of the loan. Adjustable-rate mortgages have lower starting interest rates than fixed-rate mortgages. Those low initial interest rates can entice borrowers; however, be careful. The starting interest rate may stay fixed for only one month and then you must start paying the general market interest rate, which may be much higher. But not all adjustable-rate mortgages start charging the market interest rate after one month. Some adjustable-rate mortgages have a fixed initial interest rate for up to 10 years.

Because the interest rate for adjustable-rate mortgages fluctuates with the market rates, when interest rates rise so will your mortgage payments. To keep your mortgage payments from skyrocketing, most adjustable rate mortgages have caps. There are two types of caps: interest rate and payments caps. Interest rate caps put a limit on how high your interest rate can increase. It is required by law for most adjustable mortgages to have an overall cap, which places a limit on how high your interest rates can rise over the period of your loan ("Consumer Handbook on Adjustable Rate Mortgages"). In addition to overall caps, many adjustable-rate mortgages also have periodic caps that limit how much your interest rate can rise between adjustment periods ("Consumer Handbook on Adjustable Rate Mortgages"). Interest rate caps can be great for keeping your mortgage payments lower in the short run; however, on some mortgages any increase in the interest rate that goes above the cap will be rolled over to the next period ("Consumer Handbook on Adjustable Rate Mortgages"). That means that when the market interest rate goes down, your mortgage payments could continue to go up due to accumulated interest rates that have rolled over. For example, say that your current interest rate is 4% and your cap between adjustment periods is 2%. If the market interest rate rises 4% within the first adjustment period, then your interest rate will still only rise 2% because of the cap. For the second period your interest rate would be 6% and 2% would be rolled over to the next adjustment period. As a result, your interest rate would increase to 8% during the next adjustment period. Some people get adjustable-rate mortgages because the low initial interest rates make it possible for them to afford the house they want. After the first payments, they are shocked when their monthly payments drastically increase after the initial low-rate period. To keep from experiencing that shock, ask your lender to show you what would happen in the worst-case scenario (Opdyke 47). Have them map it out in an amortization table to show you the total amount you would have to pay. That way you will be prepared if you must make some extra high monthly payments. Adjustable-rate mortgages are great for those who plan on moving before the fixed-rate term of their loan is over. They can enjoy the benefits of the low interest rate without the risk of having their rates increase over time. However, if things do not work out as planned and you don't move, make sure you will be able to afford the monthly payments after the fixed-rate period. Now that you have learned all about the different types of mortgages, it is time to look at down payments. To read the next step of our Mortgage Guide, go to Step 4: Down Payments and Your Home Mortgage Loan. The Rest of Our Mortgage Guide: Mortgage Guide Introduction Step 1: Understanding Home Loan Lending Basics Step 2: Being Pre-Qualified and Pre-Approved for Home Loans Step 3: Choosing a Type of Mortgage Step 4: Down Payments and Your Home Mortgage Loan Step 5: Term Lengths for Home Mortgages Step 6: Closing Costs For Mortgage Loans Step 7: How Much Mortgage Loan Can You Afford © Copyright www.Finackle.com |